There is something deeply satisfying attached to the act of giving a gift to someone else, and there may be times when you want to give a significant gift to a special person, but don’t understand the deal with gift tax.

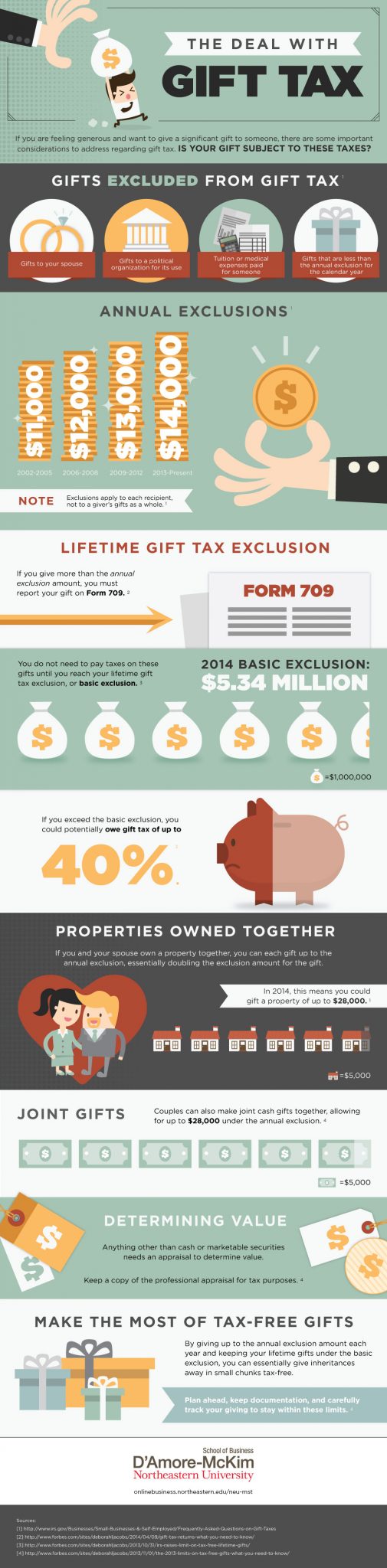

As this infographic illustrates, the regulations surrounding gift tax are not always that easy to interpret and apply to certain life situations where you might want to pass on a substantial gift to somebody else.

There are annual exclusion limits that provide some basic guidance and if you want to give a gift to your spouse for example or pay for someone’s medical or tuition expenses, you should be able to do this without being affected by gift tax.

You may not be aware for example, that you will have a lifetime gift tax exclusion threshold and this means that you can give away as much as $5 million throughout your lifetime before having to pay some taxes on the value of the gift you are giving away.

There are a number of factors to consider such as joint gifts and you should always be wary of falling foul of the exclusion limits, as it could leave you with a 40% gift tax bill to pay.

Northeastern University’s Master of Science in Taxation Online Program